Always Fresh Biker Discount News And Promotions

Posts

For each exemplory case of cost isn’t experienced on their own.. More often than not, a keen S firm doesn’t pay income tax on the its earnings. Rather, the amount of money, loss, write-offs, and credit of your own company are enacted before shareholders considering for each and every shareholder’s pro-rata share. The funds, progress, loss, deductions, and you may loans from a partnership is passed through to the couples centered on per lover’s distributive show of them items.

For those who provide simply a part as well as the individual provides the people, the new fair rental worth must be divided anywhere between both of you depending on the number for each provides. For individuals who offer anyone with accommodations, you are thought to provide support equal to the fresh fair leasing worth of the space, apartment, household, or any other shelter the spot where the people life. Reasonable leasing value has a reasonable allocation for the usage of furniture and you may devices, as well as for temperature and other resources which can be offered. The help the brand new hitched couple give, cuatro,040 (step 1,800 hotels, 1,2 hundred scientific expenditures, step 1,040 dinner), is more than half of the fresh parent’s 6,440 total service.

If you inform you a keen overpayment out of income tax immediately after finishing your Setting 1040 otherwise 1040-SR to have 2024, you could pertain region or almost everything on the projected income tax to possess 2025. On line thirty six of Mode 1040 or 1040-SR, go into the number you desire credited on the projected income tax as an alternative than simply refunded. Make number you may have credited into account whenever calculating your estimated income tax costs. If you are planning in order to file a new get back to own 2025 but your registered a joint come back to own 2024, the 2024 income tax is your show of your income tax on the joint return. You file an alternative come back for many who file while the solitary, direct of household, or hitched filing individually.

The test is also satisfied if the a child lived to you while the a part of one’s house with the exception of one needed hospital stand following the delivery.

You could potentially’t claim while the a reliant children who resides in a good overseas nation besides Canada or Mexico, except if the child are a U.S. resident, U.S. citizen alien, or You.S. federal. You will find an exception for sure used students just who resided that have everybody seasons. The 22-year-dated man, that is students, existence along with you and you may fits all the testing as your own being qualified kid.

You could fundamentally switch to a mutual come back any time in this 3 years regarding the due date of one’s independent get back or output. A different come back includes money filed on your part or your partner saying hitched submitting separately, single, otherwise head of home processing position. You could potentially find the means providing you with the two of you the lower combined taxation unless you’re expected to file separately. To choose whether you should document a profit, use in their revenues one income you acquired abroad, along with one income you can exclude underneath the overseas attained income exception. To possess information on unique income tax laws that will affect you, discover Pub.

You’re needed to duplicate and paste it to the an excellent designated the main gambling enterprise to receive your bonus. You will need to you that each single step on the journey try a smooth and seamless experience constantly. Accordingly, i claim and you will gamble the bonus our selves to be sure they matches our criteria along with your criterion.

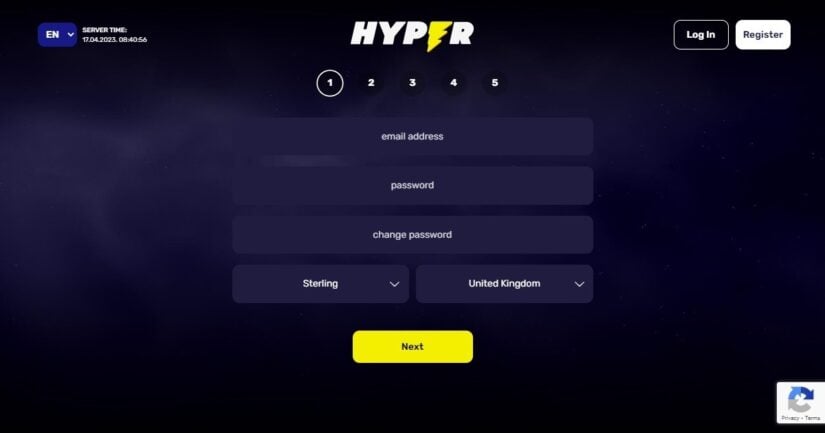

All the common percentage tricks for The newest Zealand appear. You could potentially choose handmade cards, e-wallets, bank import and instantaneous percentage possibilities. And when you completed the step 1 put Gaming Pub immediately adds your own incentive. Some tips about what I do want to find at the an online local casino, quick sign ups and easy in order to claim bonuses.